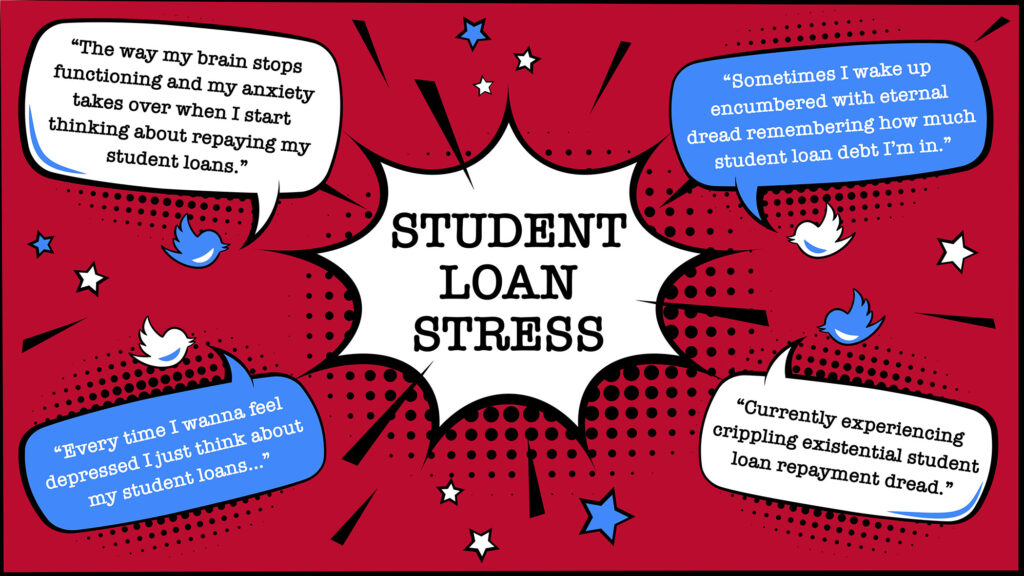

Student loan debt has become one of the most significant financial challenges facing millions of Americans today. With the cost of higher education continuing to rise, many students and graduates are left with overwhelming debt, leading to long-term financial stress. As of 2023, the total U.S. student loan debt exceeds $1.7 trillion, impacting more than 40 million borrowers.

So how can you navigate the financial stress of student loans while keeping your future on track? Here are some strategies to help you manage and potentially reduce your debt burden.

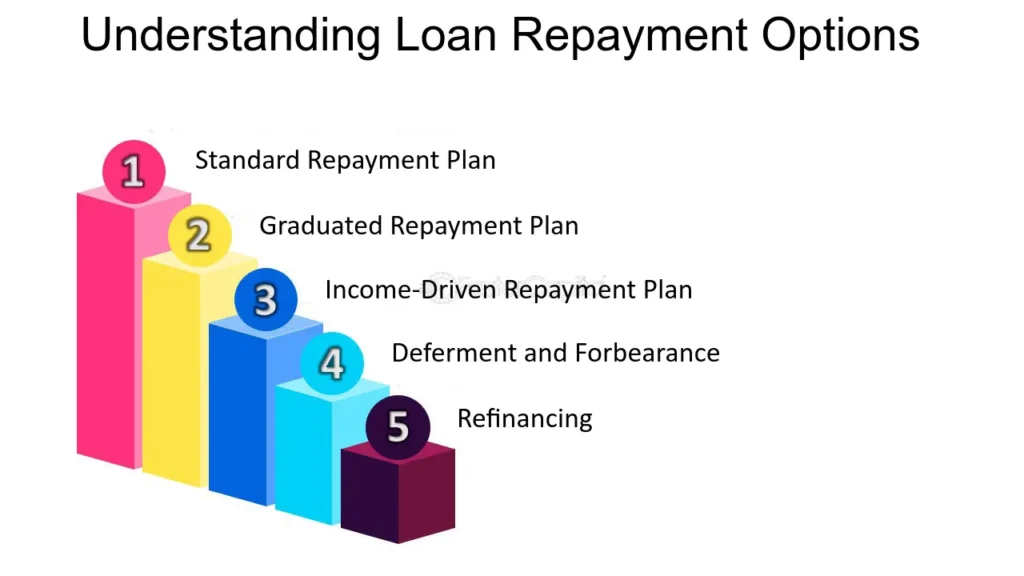

1. Understand Your Loans and Repayment Options

Before you can effectively manage your student loans, it’s essential to have a clear understanding of what you owe and the terms of your loans. Federal student loans, for example, often come with a variety of repayment options that can be tailored to your financial situation.

Once you know your loan types, explore repayment plans like:

- Standard Repayment Plan: Fixed payments over 10 years, often resulting in less interest paid overall.

- Income-Driven Repayment Plans (IDR): Monthly payments are based on your income and family size, with any remaining balance forgiven after 20-25 years.

- Graduated Repayment Plan: Payments start lower and increase every two years, ideal for those expecting to earn more over time.

- Extended Repayment Plan: Payments spread over 25 years, reducing monthly payments but increasing the interest paid overall.

Choosing the right repayment plan can help alleviate financial pressure by lowering your monthly payments or adjusting them based on your income.

2. Take Advantage of Loan Forgiveness Programs

The U.S. government offers various student loan forgiveness programs that can help reduce or eliminate your debt under specific circumstances. One of the most well-known options is the Public Service Loan Forgiveness (PSLF) program. Under PSLF.

3. Budget and Prioritize Your Expenses

Creating and sticking to a budget is crucial when managing student loan debt. It may be tempting to ignore your loans and live paycheck to paycheck, but actively prioritizing payments can significantly reduce financial stress in the long run.

Here’s how to budget effectively:

- Track your income and expenses: Understanding where your money goes is the first step in figuring out how much you can realistically pay toward your loans each month.

- Cut unnecessary costs: Look for areas where you can reduce spending, such as eating out less or canceling subscriptions.

- Build an emergency fund: Having a financial safety net can give you peace of mind, especially if unexpected expenses arise.

Once you have a budget in place, make sure your student loan payments are a top priority. Paying more than the minimum, if possible.

4. Consider Refinancing Your Loans

If you have high-interest private student loans or want to lower your monthly payments, refinancing may be an option to consider. Refinancing involves consolidating your existing loans into a new loan with a lower interest rate or better repayment terms.

While federal student loans often have protections and forgiveness programs that you’ll lose if you refinance with a private lender, refinancing can make sense if you have private loans or don’t need those protections.

5. Manage Stress with Support and Planning

Financial stress, especially related to student loans, can feel overwhelming. It’s important to acknowledge the mental and emotional toll that debt can take and take steps to reduce its impact on your overall well-being.

- Talk to a financial advisor: Sometimes, professional guidance can provide you with a clearer path forward. A financial advisor can help you create a plan, choose the right repayment strategy, and explore debt relief options.

- Seek mental health support: Many people experience anxiety or depression related to financial stress. Don’t hesitate to reach out to a counselor or therapist who can help you cope with the emotional impact of debt.

6. Advocate for Policy Changes

Student loan debt is not just an individual burden; it’s a national issue. As debates continue around the need for widespread student loan forgiveness and reform, many borrowers are getting involved in advocacy efforts. You can participate in this movement by contacting your local representatives.

Conclusion

Student loan debt can be a heavy financial and emotional burden, but by understanding your options, managing your budget, and seeking support, you can navigate the stress and set yourself up for economic success. Proactive steps can make a big difference in reducing your debt load.